ADHD Women - Are You Ready?

Are you a woman who lives with ADHD?

Are you tired of feeling overwhelmed and not feeling in control of your life?

Do you want to feel empowered in your own life?

It can feel overwhelming but you have come to the right place!

PRIVATE LIFE COACHING FOR ADHD WOMEN

One-on-One ADHD Coaching can provide you accountability, a deeper dive, focus, action steps, support, celebrations and much, much more in a safe environment.

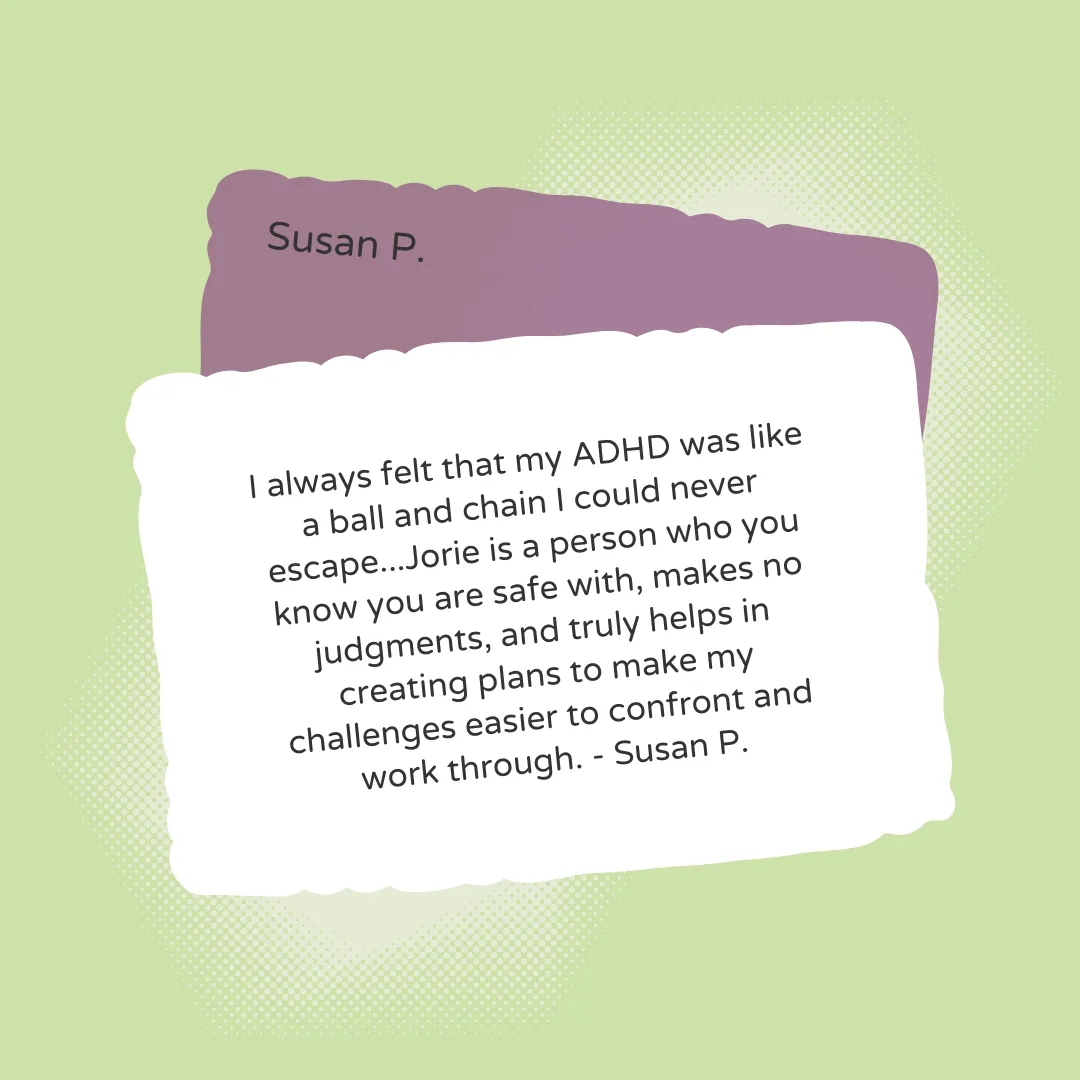

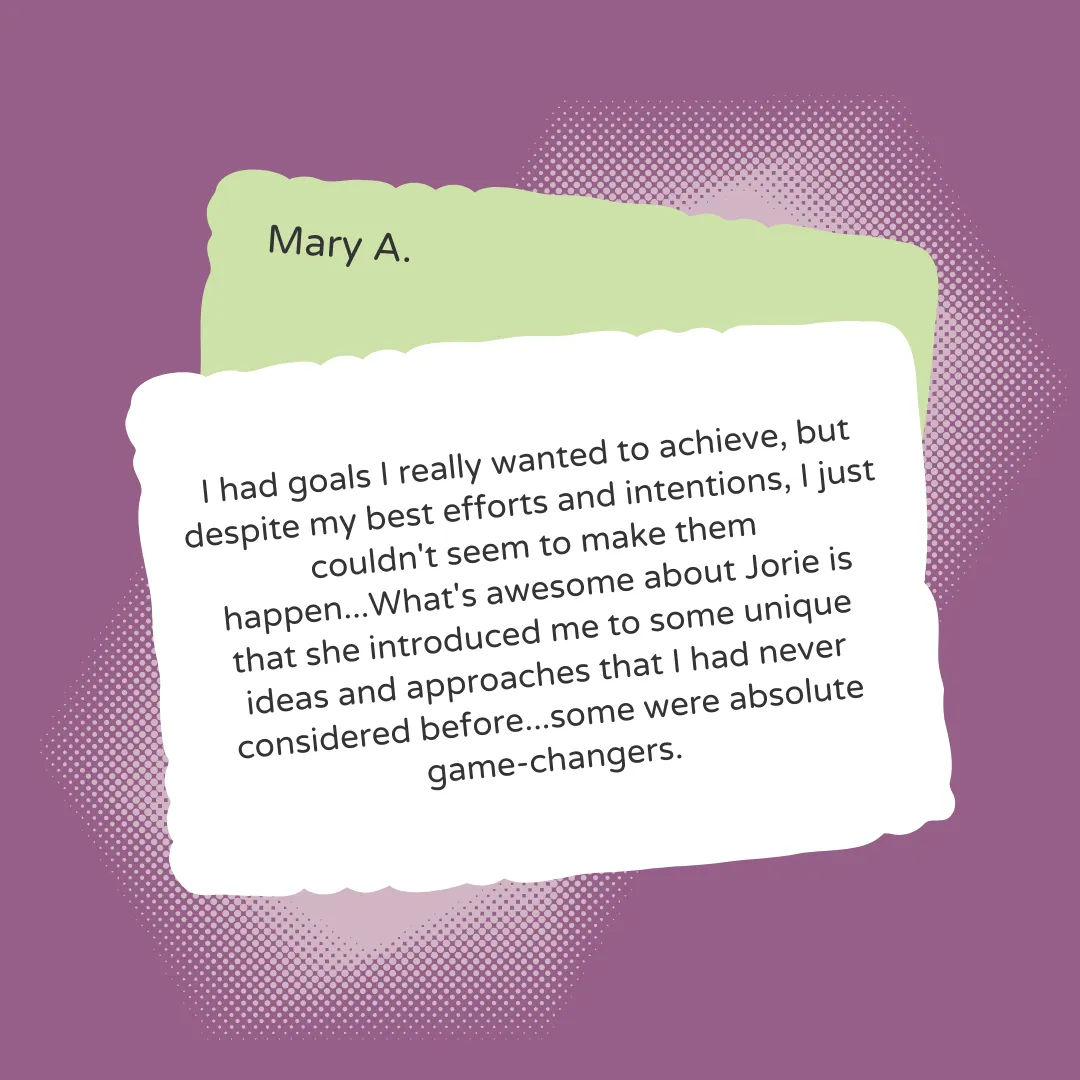

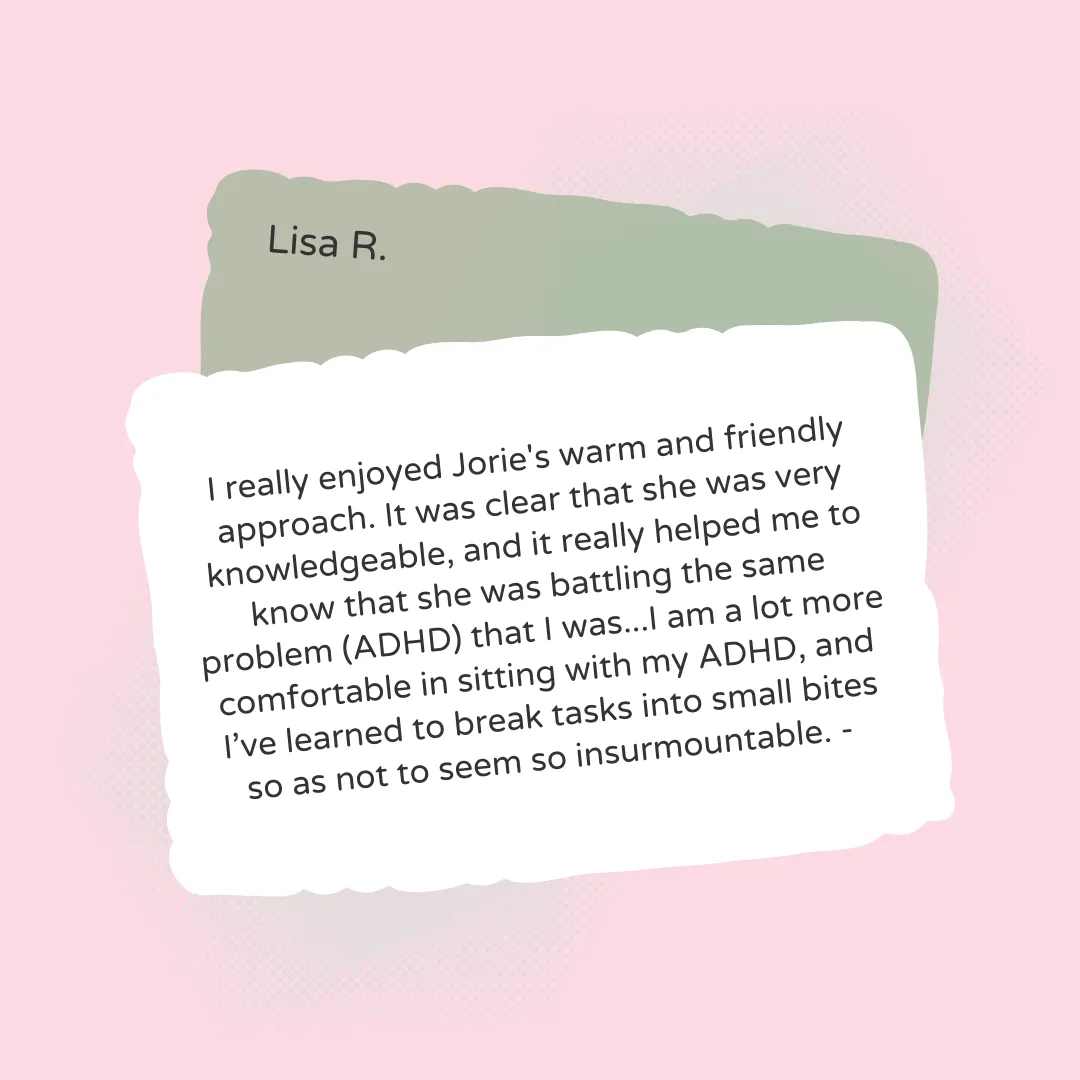

What others are saying about Jorie Houlihan...

MEET THE FOUNDER & CEO

Hey, I'm Jorie Houlihan!

I'm Your Guide for the Dopamine Deprived ™️, a Certified Professional Life Coach, Public Speaker and Certified Lifebook Leade who specializes in working with professional women who have ADHD, especially those who were diagnosed later in life.

Having lived with undiagnosed ADHD until the age of 49 myself, I understands your unique ADHD challenges, strengths and perspectives.

My goal is to help every woman living with ADHD learn how their brains work, overcome their overwhelm and feel empowered with their ADHD!